If you’re a military homebuyer – whether you’re an active-duty service member, a reservist, a veteran or a qualifying dependent – here are four mistakes you never want to make when you buy a home.

Military Buyers Beware: 4 Mistakes You Never Want to Make When You Buy a Home in Maryland

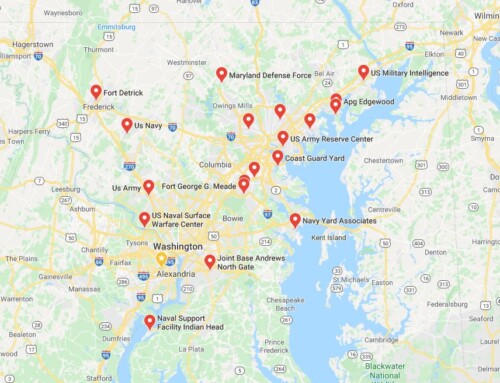

Many active duty service members stationed at Aberdeen, Fort Meade, Indian Head, one of the three active Coast Guard stations, or even Arlington or another D.C. area installation, as well as many veterans, make these three fairly common mistakes:

- Not working with a REALTOR® who understands VA loans and all their requirements

- Failing to look at a home like an investment

- Making big purchases before closing on a home

- Forgetting about up-front costs

Here’s a closer look at each.

Military Homebuyer Mistake #1: Not working with a REALTOR® who understands VA loans and all their requirements

First things first: You need to work with a REALTOR who understands your unique situation – and who understands VA loans. While many agents are capable of helping you buy a home, as a military homebuyer, you have special considerations:

- You’re likely to move in a few years

- You receive a military housing allowance

- You may have a home in another state

- You’re likely to use a VA loan, if your benefit is available to you (meaning you’re not using it on another home at the same time)

- You and your spouse may be dual military, and one of you may be stationed elsewhere before the other

- You most likely need to be reasonably close to your installation

- You may need to live near certain schools for your children

There are a number of other concerns military homebuyers have, as well, so it’s best if you work with a real estate agent who’s willing to listen, see things from your point of view, and do whatever it takes to meet your needs.

Related: First-time homebuyer programs in Maryland

Military Homebuyer Mistake #2: Failing to look at a home like an investment

Many military service members think that there’s no sense in buying a home when there’s a good chance that they’ll be moved in a few years – but buying a home can be a fantastic investment. It can turn into a rental property when you leave, and then, should you decide to return later, it can be the perfect place to retire.

Many military homeowners use rent payments to pay the mortgage on a home. Often, they’ll hire a property manager to handle issues while they’re out of state or deployed, too.

But if you really don’t like the idea of becoming a landlord, you can sell when you leave. VA loans are assumable, too, which means that another person who qualifies for a VA loan can simply take over your payments.

Related: Everything you need to know about VA loans

Military Homebuyer Mistake #3: Making big purchases before closing on a home

Whether or not you’re using a VA loan, you can’t make big purchases before you close. Opening a line of credit is a mistake, too. You need to keep your financial picture the same – or as close as possible – as what it was when your lender approved you for your loan… at least until closing day when you sign the paperwork and actually own the home. Making big purchases or opening a new line of credit can affect your mortgage approval, and that’s the last thing you want when you’re buying a home. It could push back your closing date – or worse, it could cause your lender to withdraw its approval for your loan.

Military Homebuyer Mistake #4: Forgetting about up-front costs

If you’re using a VA loan, you can buy a home with nothing down – but you may still have some upfront costs to handle. Your closing costs might include things like the home appraisal, the VA funding fee, a home inspection and a few other “incidentals.” In some cases, the seller pays your closing costs, but that’s not always true. And it’s always better to be safe than sorry, so make sure you have some cash set aside for the things you’ll most likely have to pay for. Talk to your REALTOR about possible closing costs that will come from your own pocket so you’re prepared.

Related: 5 closing costs to be aware of when you sell your home

Are You a Military Homebuyer in Maryland?

If you’re an active-duty service member, reservist, veteran or qualifying dependent, I can help you find the right home in Ellicott City, Catonsville, Columbia, Pikesville, Owings Mills or another local community. Call me at 443-955-1227 or 410-465-5822 right away to tell me what you’re looking for – I’ll help you find it.

While you’re here, check out:

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

Follow Us