Buying a new home in Maryland is exciting – and it’s also a really busy time for most people. From coordinating home inspections to buying a new welcome mat for the front porch, there’s always something to do. And one of those things – a very important one – is buying homeowners insurance.

But what is homeowners insurance for, who does it benefit, and how (and when) should you get it? This homebuyer’s guide to homeowners insurance explains.

The Homebuyer’s Guide to Homeowners Insurance

Generally speaking, homeowners insurance is a must-have. If you’re buying a home with a mortgage loan, your lender will most likely require it – but even if you’re paying cash, it’s still a good idea to buy insurance to protect your investment.

Related: Will student loan debt prevent you from getting a mortgage?

Why is Homeowners Insurance Necessary?

Homeowners insurance is often a lender requirement. In fact, you have to show proof of insurance before your lender will give the money you’re borrowing to the seller. That’s because lenders assume certain risks when they let you borrow money to purchase a home – and among them is the risk that something will happen to the property and you’ll walk away from the mortgage, leaving the bank on the hook to pay for the damages.

Even if you’re buying with cash, though, homeowners insurance is a good idea; it protects you in the event that something happens to your home.

When Do You Need Homeowners Insurance?

You typically have to buy your homeowners insurance policy before you close on your home. In fact, your lender will most likely want to see proof of insurance at least a few days before closing day. That means after the seller accepts your offer, you have a green light to start calling around and comparing rates.

You should try to get quotes from at least three insurance companies. Then, you can zero in on the best choices for you based on what each company tells you.

Related: Can you buy a FSBO if you have a real estate agent?

What Will Homeowners Insurance Cover?

Homeowners insurance covers natural disasters and a few other things. Most policies cover:

- Wind and hail damage. About one in 40 homeowners file wind and hail damage claims each year.

- House fires and lighting strikes. Around one in 350 homeowners files a claim related to house fires and lightning strikes annually.

- Water damage. Somewhere in the neighborhood of one in 50 homeowners files a claim related to water damage from leaky roofs, burst pipes or other water-related issues every year.

- Theft. On average, one in 400 homeowners files a theft claim with their homeowners insurance company every year.

- Personal injury damages (such as when a guest gets hurt on your property).

It’s important to note that most homeowners insurance policies don’t cover flood damage – you need separate coverage for that. (You can check local flood zones here.)

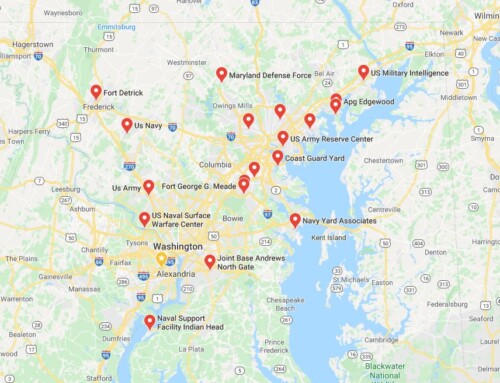

Are You Buying or Selling a Home in Baltimore County or Howard County?

If you’re ready to buy or sell a home in Baltimore County or Howard County, we can help. Check out these listings:

- Homes for sale in Baltimore County

- Homes for sale in Howard County

- Homes for sale in Ellicott City

- Homes for sale in Columbia

- Homes for sale in Catonsville

- Homes for sale in Owings Mills

- Homes for sale in Pikesville

If you’re thinking about selling your home, we can help you sell it quickly – and at the best possible price. You can:

- Find out how much your home is worth now

- Learn how we market your home to put it in front of all the right buyers

- Get a general overview of home-selling in Maryland

If you have specific questions, fill out the form below or call us at 443-955-1227 – we’re here to help you with any aspect of your real estate transaction.[wpforms id=”220617″]

Follow Us