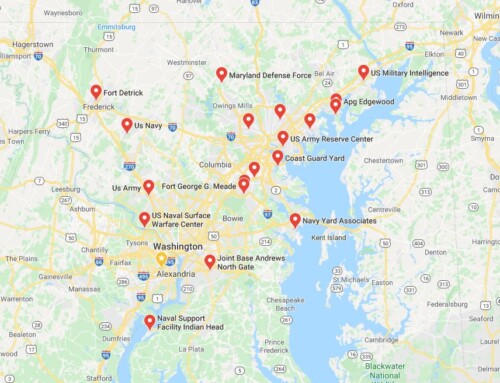

When you’re buying a home for sale in Ellicott City, Owings Mills or another area, your lender will require you to buy title insurance. (If you’re not using a lender and you’re paying cash, it’s probably still a good idea to buy title insurance – but that’s another post for another day!)

In order for a title insurance company to issue a policy, it will have to perform a title search.

What is a Title Search?

A title search is a deep-dive into property records to determine whether there’s anything involved with the title that could affect your ownership of the home in the future. For example, if a deed was recorded wrong, someone else could have a claim to all or part of the property – regardless of the fact that you bought it from the seller. A title search will uncover issues like those.

What Do They Look at During a Title Search?

During a title search, the title agency will look at many sources, including:

- County land records

- Deeds

- Tax liens filed at the state level

- Tax liens filed at the federal level

- Divorce records

- Bankruptcy court records

- Financial judgments against an owner

Search Ellicott City and Owings Mills Homes for Sale Now

[idx-omnibar styles=”1″ extra=”0″ min_price=”0″ ]What Are the Most Common Title Problems?

The most common title problems include:

- Errors in public records, such as clerical errors or filing errors. A technicality could prevent you from owning the home free-and-clear.

- Unknown liens, which mean prior owners may owe money (and that bill could transfer to you if you buy the home). Banks and other financial institutions can put a lien against your property for unpaid debts even after you close a sale, so this is a big issue with foreclosures and other distressed properties.

- Missing heirs, such as a person who comes forward after someone’s death to make a claim against that person’s estate. Sometimes when a person dies, he or she doesn’t include everyone in a will – or the person does include everyone, but the person who has ownership in the home can’t be found.

- Illegal deeds, such as when a deed was made by someone who isn’t legally authorized to make it (like a minor, a person of “unsound mind,” or someone who says he or she is single but is actually married).

- Forgeries, such as when someone fakes a document to claim ownership in a property and then files that document with the state or county.

- Unknown easements, such as when a government agency, business or even another person has legal access to all or part of the property.

- Undiscovered wills, such as when a property owner dies with no will or apparent heir and the state sells his or her assets – but someone later discovers that the person had a will.

If the title search doesn’t turn up any of these (or any other) issues, the title insurance agency will most likely issue you a policy.

Are You Buying a Home in Ellicott City?

If you’re ready to buy a home for sale in Ellicott City, we can help you find the right one.

Call us at 410-465-5822 to tell us what you want from your next home or to schedule a tour in a home you’ve seen online.

Use these links to check out the hottest listings:

Follow Us