If you’re buying a home for sale in Ellicott City, your lender will want plenty of paperwork to back up your financial claims and make a lending decision.

You’ll have to have everything ready when your lender needs it, too, because if you don’t, you could delay your closing and have to wait even longer to get into the home of your dreams.

Related: Mortgage basics for buyers

What Paperwork Do You Need to Get a Home Loan in Ellicott City?

Your lender will have a specific list of requirements, but here’s a quick list of the paperwork you’ll need to get a mortgage. That way, you can prepare ahead of time.

- Two forms of identification

- Social Security number

- Proof of income for every borrower on the loan application, including two years of W2s or pay stubs

- Two years of tax returns

- Documents that prove other sources of income (like child support, alimony or Social Security income)

- Proof of assets for every borrower on the loan application, including two to three most recent bank statements

- Letters of explanation for money that you’re using that was given to you as a gift

- A credit report disclosure form that gives the lender permission to pull your credit report

- Information on past bankruptcies or foreclosures

- Proof that other loans are paid off

- Information on other properties you own

Are You Buying a Home in Ellicott City?

If you’re ready to buy a home for sale in Ellicott City, we can help you find the right one.

Call us at 410-465-5822 to tell us what you want from your next home or to schedule a tour in a home you’ve seen online.

Use these links to check out the hottest listings:

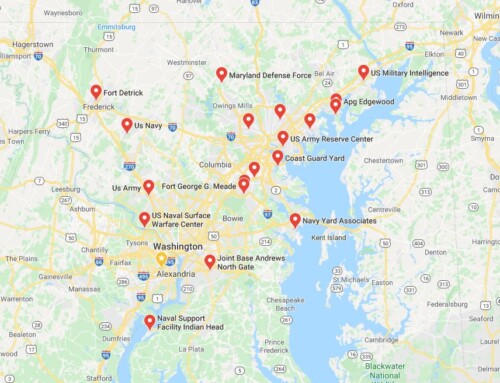

- Ellicott City homes for sale

- Columbia homes for sale

- Catonsville homes for sale

- Pikesville homes for sale

- Owings Mills homes for sale

Follow Us