If you’re like many honorably discharged veterans of the U.S. Armed Forces, you’re eligible for a VA loan – but should you use this free (and well-deserved) benefit? Here’s what you need to know.

3 Big Benefits of Using a VA Loan to Buy Your Next Home in Baltimore County

A VA loan comes with a wide range of benefits for homebuyers, whether you’re looking for your first home for sale in Baltimore County or your fifth. The three most notable are:

- No down payment

- No prepayment penalty

- No private mortgage insurance requirement

Here’s a closer look at each.

Related: What is a VA loan?

No-Down Payment VA Loans

You can buy a home with nothing down if you’re using your VA loan benefit. The no-down-payment makes these types of loans far more attractive than conventional loans are – but remember, the more you borrow, the higher your monthly payments will be. If you can even come up with a few thousand dollars to put down, you could lower your payments significantly.

Pro Tip: Nothing down doesn’t necessarily mean you don’t have to pay some out-of-pocket costs. You’ll still be required to pay the closing costs you’re responsible for, and you’ll still have to come up with an earnest money deposit when you find a home you’re interested in.

No Prepayment Penalty on VA Loans

Here’s the deal: Many lenders don’t want you to pay off your loans pay off your loans early because it means they’ll miss out on interest payments; for that reason, they charge you a prepayment penalty. However, they can’t do that if you have a VA loan – the law doesn’t allow it. That means you can make extra payments toward the principal on your loan and shave time off the back end, or you can make a balloon payment and pay off your loan all at once without having to pay costly fees.

Related: Tips for buying a home in the Baltimore suburbs

No Private Mortgage Insurance Requirement

When you borrow using a conventional loan, you usually need to put down at least 20 percent of the home’s purchase price – and if you don’t, you have to buy private mortgage insurance. Private mortgage insurance protects the lender in case you walk away from the deal without paying off your obligation. It can be pretty expensive, too, and you have to keep paying it until you’ve built 20 percent equity in your home. However, lenders aren’t allowed to make you buy private mortgage insurance, or PMI, if you’re using a VA loan.

Related: 3 common mortgage questions when you buy a home

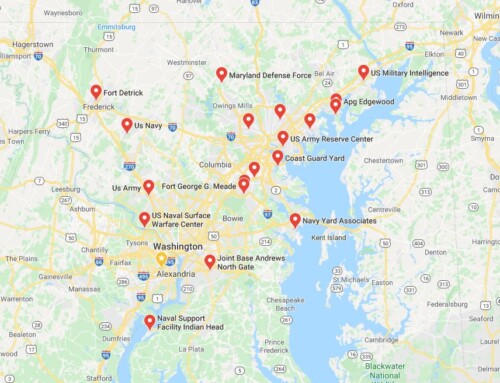

Are You Buying or Selling a Home in Baltimore County or Howard County?

If you’re ready to buy or sell a home in Baltimore County or Howard County, we can help. Check out

these listings:

Homes for sale in Baltimore County

Homes for sale in Howard County

Homes for sale in Ellicott City

Homes for sale in Owings Mills

If you’re thinking about selling your home, we can help you sell it quickly – and at the best possible price. You can:

Find out how much your home is worth now

Learn how we market your home to put it in front of all the right buyers

Get a general overview of home-selling in Maryland

If you have specific questions, fill out the form below or call us at 443-955-1227 – we’re here to help you with any aspect of your real estate transaction.

[wpforms id=”220617″]

Follow Us